From 1.4.2009, you won’t have to pay advance tax if your tax liability is less than Rs 10,000 annually.

The limit has been hiked “with a view to providing for inflation adjustment”, says the memorandum. The Rs 5,000 limit has been in existence for the past 13 years. It was fixed in the 1996 Budget.“This gives a further leeway to individual taxpayer to pay the entire income tax at the end of every year,” said Vikas Vasal, executive director, KPMG.

Advance tax applies to individuals whose incomes are not subject to tax deduction at source (TDS).

This directly impacts the self-employed in the lower tax slab. This tax is also payable on income on account of interest, tuition fee, rent, trading of securities and consultancy work

Advance tax is paid every quarter. If not paid on time, it attracts a penalty at an annualised rate of 13 per cent.

Let’s look at what is the difference the hike, included under the existing provisions of Section 208 the Income-Tax Act, has made to individuals.

Considering the earlier exemption of Rs 1.5 lakh and Rs 1 lakh deductions, a person was liable to pay advance tax if he was earning a salary of more than Rs 2.75 lakh.

This year onwards, advance tax has to be paid by people earning over Rs 3.10 lakh. The salary level increases as the exemption limit is now Rs 1.6 lakh.

“This move impacts individuals in the lower income group. For those in the high income slab, this is immaterial,” said K H Viswanathan, executive director, RSM Astute Consulting Group.

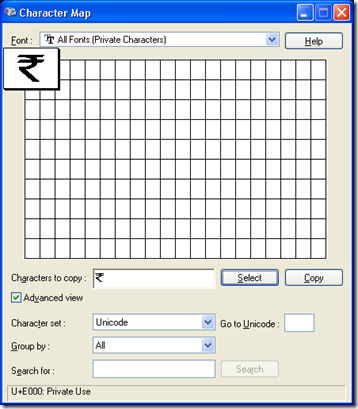

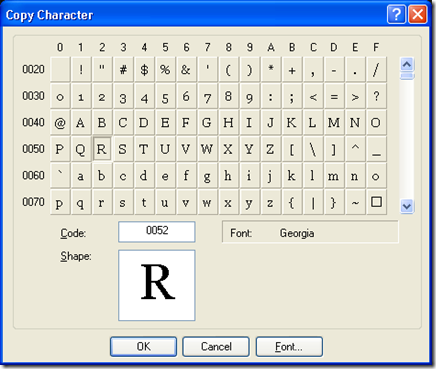

![clip_image002[1] clip_image002[1]](http://mscoder.files.wordpress.com/2010/07/clip_image0021_thumb1.jpg?w=295&h=346)